Low Salary Increases the New Norm?

Salary increases at all levels remain low, and are likely to remain so, according to latest survey.

14 Mar 2013

Salary increases at all levels remain low, and are likely to remain so, according to the latest pay survey conducted by remuneration specialists MHR Global Ltd.

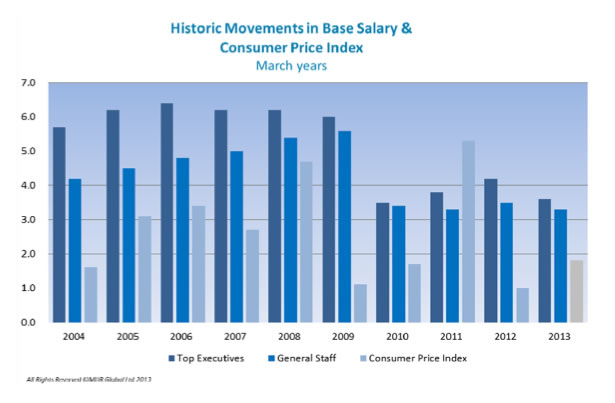

New Zealand’s longest established commercial survey has been running since 1959, and analyses over 35,000 individual records from 416 organisations throughout New Zealand. The latest update as at 1 March 2013 found that over the 12 months to March 2013 base salaries rose by an average of 3.8 percent for Chief Executives and General Managers, 3.6 percent for Top Executives (including CEOs and direct reports), and 3.3 percent for all other staff.

“These figures continue the pattern of low levels of increases recorded each year since our March 2010 survey” says Kevin McBride, Managing Director of MHR Global. “Increase levels remain well below the levels recorded over an extended period prior to 2010, in which average increases of 6.0 to 6.5 percent for Top Executives and 4.7 to 5.5 percent for General Staff were common.”

Mr McBride commented that contrary to popular belief the majority of Top Executives are not receiving inordinately high increases at the expense of other staff. “Our results show that this perception is more the result of a small number of high profile cases which were widely reported, but which have little impact on the overall figures. Unfortunately these perceptions may increase expectations across the board, and prompt unrealistic demands. Managing and responding to such demands in the current environment will be challenging.”

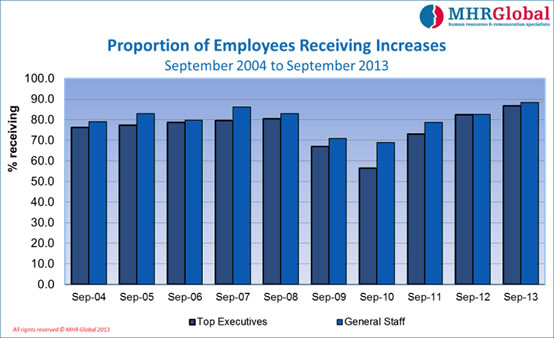

Balancing the low increases to some extent is the fact that the number of staff receiving increases has lifted back to pre‐2010 levels of around 70 percent, a marked improvement from recent years in which the proportion of staff receiving increases fell to close to 50 percent as employers sought to contain costs to cope with reduced revenue and funding.

“Taken together these two changes indicate that while the difficult economic conditions prevail, it is no longer practical to continue the wage freezes which were common during the height of the Global Financial Crisis. As a result employers are showing greater willingness to provide some level of adjustment to the majority of staff, but remain constrained in the levels of increase which are affordable. That pattern is likely to continue for some years yet.”

The survey also shows that movements in median total remuneration – an aggregate of changes in base salary, benefits and bonuses, and appointment levels for new appointments – remain low, with an increase of just 2.3 percent in Median Total Remuneration for roles below Top Executive level.

“Again, this is a reflection of the challenges facing employers,” says Mr. McBride. “Low median total remuneration movements are the result of lower levels of recruitment activity, ongoing retrenchments, and the relatively low base salary movements. A major factor in this is that new appointees are typically paid lower than the people they replace, and this reduces the impact of the base salary increases of other staff. This effect is likely to be more pronounced during periods of increasing unemployment.”

At an industry level the survey results confirm the challenges being faced by many sectors, with average increases contained within a relatively narrow range. “This contrasts with past surveys, in which there has been wide variation in the level of increases awarded in different sectors” Mr McBride commented. “While individual organisations may be experiencing improved conditions, most sectors continue to confront tough financial conditions, and need to maintain a close control of their cost base.”

Mr. McBride suggested that in the short to medium term it was unlikely that New Zealand employees would experience the high level of pay adjustments seen prior to the financial crisis. “These results show that the majority of employers continue to monitor operating costs closely. With remuneration costs representing a sizable portion of the budget for all organisations, wage restraint will continue to be the norm for the foreseeable future. Clearly that will make it difficult for initiatives such as the “Living Wage” campaign to have any real traction until economic conditions improve markedly.”

Previous news items

| Title | Published |

|---|---|

| Executive Pay Index A different perspective on pay margins |

19 Sep 2014 |

| September 2014 Results Pay Increases Remain Constrained |

11 Sep 2014 |

| Increasing Support for Incentive Payments September 2013 Results |

2 Oct 2013 |

| Low Salary Increases the New Norm? Salary increases at all levels remain low, and are likely to remain so, according to latest survey. |

14 Mar 2013 |

| Latest MHR-Global Remuneration Survey Proportion of employees receiving pay increases returning to pre-Global Financial Crisis levels |

19 Sep 2012 |